Price charts for Binance Coin, Solana, Cardano, Polkadot, Luna, and Avax. Each candle in the charts represents a 3-day period.

As an exception, Cardano (ADA) made its new all-time high two months before (in early September) Ethereum. However, in return, it was faced with the most ferocious correction during the last 3 months, dropping all the way back to its summer lows. Cardano is the only cryptocurrency among the top 10 coins that has retracted back to the July 2021 lows. Issues going on with Cardano’s project team also contributed to its unique price drop besides the look of its technicals.

The other exceptions are Avalanche (AVAX) and Terra (LUNA), both of which made new record prices that are much higher than their early-year all-time highs (Avax by 2x and Luna by 5x). Terra specifically succeeded in continuing its uptrend throughout December, when the entire market was falling down.

Now that all uptrends are gone and everything in the market is correcting, these major cryptos are likely to correlate back to Ethereum, and Ethereum back to Bitcoin.

Bitcoin Mining Developments:

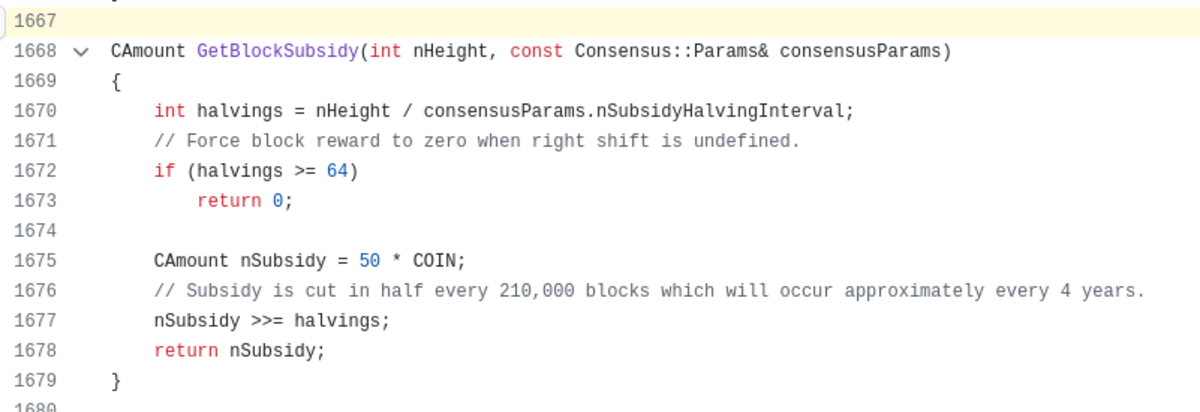

Hash Rates Drop Due to Kazakhstan’s Internet Shutdown

The Kazakhstan government shut down the internet on January 5 in an effort to crack down the rising fuel cost protests. The loss of internet connection has adversely affected the country’s Bitcoin mining pools.

Kazakhstan currently constitutes the second largest Bitcoin mining capacity in the world (at 18%), in the wake of China’s mining bans. A large number of miners from China flocked to Kazakhstan during the summer of 2021 due to exceptionally low energy prices in this country.

Now that the Kazakhstan government has cut off internet access to suppress the escalating protests, the country’s Bitcoin mining operations are jeopardized. Some of the worst impacted mining pools so far are 1THas, which experienced a whopping 82% decline in its hash rate, while OKExPool and KuCoinPool, mining pools of two of the largest cryptocurrency exchanges in the world, took a hit of 46% and 23%, respectively.

Despite these concerning developments, the hashrate drop is still far smaller compared to the drop back in May and June 2021, when China banned the entire Bitcoin mining ecosystem in its jurisdiction.

Corporate Treasury Updates:

Microstrategy Adds More Bitcoin to its Treasury

Microstrategy purchased 1,914 BTC for $94.2 million on December 30. The company now holds ~124,391 BTC at a rate of ~$30,159. The total treasury was valued at ~$5.7 billion at the end of 2021, giving the company ~$2 billion in profit on its position.

Michael Saylor’s high conviction bet has gotten the attention of corporate leaders, including Elon Musk, who have adopted BTC as a reserve asset to some capacity. The systematic framework of most corporations disallows them from purchasing BTC at will. Approval processes and other measures must be satisfied before making such a move. The start of a new year has the potential to see more companies follow Saylor’s lead.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments