Bitcoin futures data counters the assumption that BTC’s rally to $42,000 was primarily propelled by shorts liquidations. What is next for BTC?

In the past seven days, Bitcoin (BTC) experienced a whopping 14.5% surge, hitting a 20-month high at $41,130 by Dec.

BTC liquidation map

— Nik Algo (@nik_algo) December 4, 2023

Enough shorts to run it up all the way to $45-46k pic.twitter.com/7O2zYD4j8Q

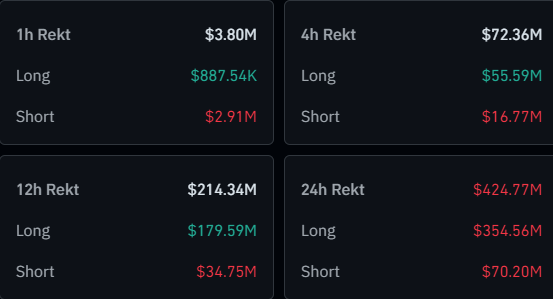

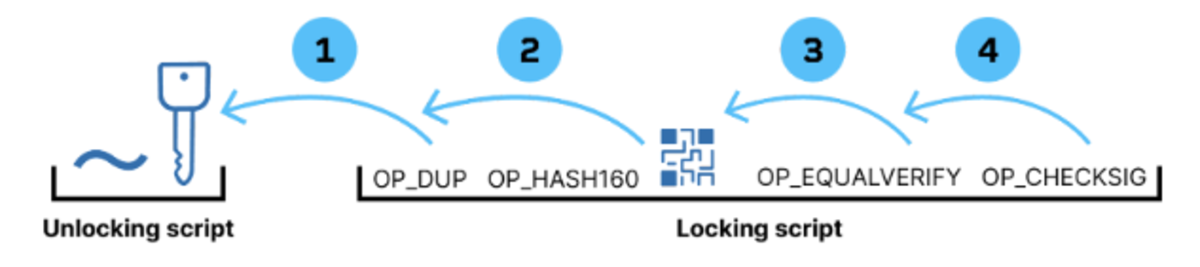

The impact of the recent liquidations in Bitcoin futures markets

While the Chicago Mercantile Exchange (CME) trades USD-settled contracts for Bitcoin futures, where no physical Bitcoin changes hands, these futures markets undoubtedly play a crucial role in shaping spot prices.

In the same seven-day period, a mere $200 million worth of BTC futures shorts were liquidated, representing only 1% of the total outstanding contracts.

Even when focusing solely on the CME, which is known for potential trading volume inflation, its daily volume of $2.67 billion should have readily absorbed a $100 million 24-hour liquidation.

$BTC Next Possible Plan

— VeLLa Crypto (@VellaCryptoX) December 4, 2023

A Quick Wick to 42k-42.5k To Hunt BSL Of Shorts then A Quick Flushout of the Long's & We Might see $BTC Pullback down to 39k-38.5k

Retracement to 39k-38.5k Will be good Buying Opportunity For the Last Leg upto 45k-47k Before ETF Approval pic.twitter.com/yc7k0hOBpZ

One could attempt to gauge the extent of liquidations at different price levels using tape reading techniques.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments