In this week’s crypto highlights, we explore the price movements of BTC, ETH, BCH, and KAVA. Additionally, this recap includes other notable industry news items that occurred over the last seven days. Without further ado, let’s dive into the latest market developments.

Noteworthy market events

Prime Trust suspended operations following the Nevada regulator’s order

On June 21, The Nevada Department of Business and Industry ordered crypto custody firm Prime Trust to cease all activities that violate state regulations. In its order, the department stated that the company’s “overall financial condition…has considerably deteriorated to a critically deficient level.” Furthermore, the regulator alleges that Prime Trust is “operating at a substantial deficit,” in other words, potentially insolvent. Shortly after the order was made public on the Nevada regulator’s website, BitGo announced it has terminated its plans to acquire Prime Trust.

Following the directive, Prime Trust suspended its fiat and crypto transactions. Initially, news of the suspension was announced by its partner, Stably. The issuer of the TrueUSD (TUSD) stablecoin said that its operations were not affected as they “have no exposure to Prime Trust and maintain multiple USD rails for minting and redemption.” Despite this, TUSD temporarily depegged following the news.

A few days after these events, Nevada’s Financial Institutions Division filed to place Prime Trust in receivership, and freeze all of its operations. According to the filing, Prime Trust owes its clients $85 million in fiat, and $69.5 million in crypto. However, the company holds only around $3 million in fiat, and $68.6 million in crypto. Adding to the severity of the situation, Prime Trust’s largest holding, valued at approximately $61 million, consists of a relatively illiquid token called AUDIO.

The filing also mentioned that part of this shortfall comes from Prime Trust’s inability to access “legacy wallets.” In an attempt to cover up their financial troubles, it’s alleged that Prime Trust resorted to purchasing cryptocurrencies using customer funds. In essence, new customer deposits were used to repay old customers.&

The SEC approved the first-ever leveraged Bitcoin futures ETF

The U.S. Securities and Exchange Commission (SEC) approved Volatility Shares’ 2x Bitcoin Strategy ETF (BITX), making it the first leveraged crypto ETF available in the U.S. This ETF allows customers to gain exposure to Bitcoin with only half of the asset’s value as collateral. The filing said the instrument would correspond with the CME Bitcoin Futures Daily Roll Index.

This led to speculation that BlackRock’s filing, and potentially other spot Bitcoin ETF applications, could be approved by the regulator as well. For instance, the ETF Store President Nate Geraci said that “It seems absolutely ridiculous that investors are getting a 2x leveraged Bitcoin futures ETF before they have access to a straightforward spot Bitcoin ETF.”

BITX started trading on June 27, witnessing about $4.2 million worth of trading volume on its first day of operation.

Jerome Powell sees “stablecoins as money”

During the U.S. House Financial Services Committee’s semiannual meeting on monetary policy, Federal Reserve Chair Jerome Powell recognized stablecoins as a form of money. In response to U.S. officials on a proposed stablecoin bill, which would create 58 different licenses with federal regulatory approval, Powell stated:

“We do see payment stablecoins as a form of money, […] and we believe that it would be appropriate to have quite a robust federal role in what happens in stablecoin going forward.”

Powell’s perspective differs from that of SEC Chair Gary Gensler, who has said that all cryptocurrencies except Bitcoin are securities. It also contrasts with the viewpoint of Commodity Futures Trading Commission (CTFC) Chair Rostin Behnam, who perceives stablecoins as commodities.

Matter Labs released a toolkit for building Ethereum rollups

Matter Labs, the team behind zkSync Era blockchain development, introduced ZK Stack, a modular framework for a series of custom blockchains called Hyperchains. Based on hyperchains, Matter Labs wants to create a network of interconnected blockchains using zero-knowledge (ZK) proofs. It is assumed that zkSync Era will become the first hyperchain.&

The presented architecture allows developers to create layer 2 (working in parallel with zkSync Era) and layer 3 (on top of this solution) hyperchains. Developers can customize hyperchains depending on the intended purpose of the blockchain, from the choice of sequencer and data availability mode, to defining their own tokenomics.

The initiative could be a response to a similar move by Optimism, whose developers presented a similar superchain project.

One sentence news

- CACEIS, the asset servicing arm of banking giants Crédit Agricole and Santander, has been registered by French regulators with clearance to provide crypto custody services.

- Optimism, the layer 2 (L2) Ethereum network, changed its name to “OP Mainnet,” to reflect the project’s objective to create a “superchain” network of many L2 blockchains.

- MakerDAO drastically reduced the share of the USDC stablecoin in its DAI collateral, from 4.4 billion USDC to 521 million.

- HSBC has become the first Hong Kong bank to allow its customers access to Bitcoin and Ethereum ETFs on its investment platform.

Bitcoin price reached its 2023 high

After BlackRock’s submission for a Bitcoin trust, which works as a spot ETF, more institutional investors became interested in the largest digital asset. According to CoinShares, major U.S. financial institutions managing $27 trillion are “actively” pursuing opportunities to offer their clients access to Bitcoin. CoinShares also highlighted that digital asset funds experienced the largest weekly inflows since July 2022. 94% of the total flows were dedicated to Bitcoin-related funds, including BITO and GBTC.&

This helped Bitcoin reach its 2023 high, breaking the $31,000 level. According to Kaiko, Bitcoin outperformed tech stocks this month jumping nearly 14%, with the Nasdaq 100 up only 3%. As a result, Bitcoin’s correlation with Nasdaq 100 hit its lowest level in nearly three years.

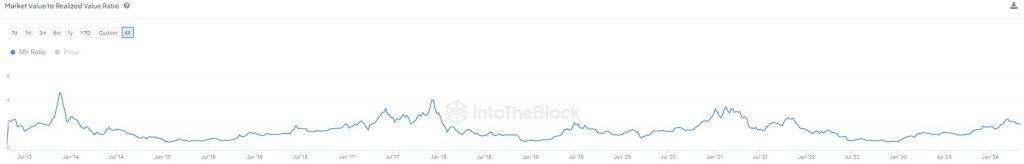

However, according to LookIntoBitcoin, the RHODL ratio metric is on the rise, suggesting that the BTC supply is beginning its move from a hodler-based, to a speculative instrument. In addition, Glassnode reported that short-term holders are sitting on a 12% profit. Typically, the probability of market corrections tends to rise when the metric is within 20%-40%, as investors could be more tempted to fix profits.&

The recent rally pushed the BTC price to the mean reversion level on a weekly chart. The asset is currently consolidating near this area, and experienced several failed attempts to sustain above it. Weekly RSI formed a bearish divergence, indicating that upward momentum may be fading.&

Lower timeframes also hint that a price correction may take place, especially if the asset fails to keep a psychological level of $30,000. If broken, the closest major support level could be near $27,800.&

The next month, July, historically favors Bitcoin as the BTC price gained at least 20% during that period over the last three years. Yet at the same time, this period is typically characterized by lower volatility, meaning existing market consolidation has the potential to continue.

More staked ETH than held on exchanges

Recently, CryptoQuant reported that nearly 20% of ETH is now staked. Nansen data shows that ETH staking deposits are increasing, with stakers predominantly withdrawing& rewards. As a result, the number of staked ETH managed to exceed that of ETH held on exchanges. This led to speculation that the available ETH supply is becoming more scarce. Thus, if the demand for ETH remains the same or increases further, it could lead to positive buying pressure on the asset.

However, back in 2020, Messari reported that the correlation between the percentage of staked supply and price returns is fairly weak. In some cases, staking can reduce token velocity, potentially having the secondary effect of increasing volatility and decreasing market pressure. But the price movements typically depend on project developments and the general direction of the market. According to CryptoWatch, the 30-day Ethereum-Bitcoin correlation is 85%.&

In addition, the majority of staked ETH is liquid, meaning stakers can transact elsewhere with tokens that represent their assets. Liquid staking provider, LidoDAO, continues to dominate the DeFi sector by total value locked (TVL), being responsible for over 30% of the TVL across all blockchain networks. LidoDAO is also one of the best-performing DeFi projects in terms of TVL increase over the last 30 days. As a result, the increased staking ratio is unlikely to significantly affect ETH price performance.

Following increased optimism in crypto markets, the ETH price managed to bounce off the 200-day SMA, which has been recently acting as a major dynamic support level. The asset broke the descending resistance line (white line), but after reaching the $1,925 level, it started to consolidate in a narrow range.

The rising 20-day EMA, and daily RSI in positive territory, hints at a potential uptrend continuation. But on lower timeframes, indicators suggest the weakening of bullish momentum. The following price movement could depend on whether or not the asset defends the former descending resistance line.

BCH surged by over 100% in a week

Bitcoin has garnered such buzz that even other assets containing its name experienced a rally. For instance, Bitcoin Cash (BCH) and Bitcoin SV (BSV) prices temporarily jumped by over 100% and 50% in a week, respectively.

The BCH performance is likely related to the EDX Markets crypto exchange, which was recently launched by Fidelity and other financial giants. BCH is one of four supported assets on the platform. This helped the asset reach levels last seen in May 2022.

However, the four-hour chart indicates that upward momentum is gradually decreasing as the asset formed a strong bearish divergence with both RSI and MACD (white lines). The closest major support level could be near $191, where the 0.382 Fibonacci point is located.&

KAVA price increased amid adding USDT support

On July 3, 2023, the USDT stablecoin will be deployed on the Kava blockchain. Following this news, the KAVA price experienced a price increase of over 30% in a few days, reaching major resistance near $1.13. However, soon afterward the asset lost more than half of its gains, approaching the 50-day SMA.

Daily RSI moved to the neutral territory, but the indicator moved out of the oversold zone on lower timeframes. This suggests that the asset may experience temporary relief. The closest resistance level could be the $0.98 level. If the price breaks 50-day and 200-day SMAs, this could push the asset to the $0.81 support area.

Tune in next week, and every week, for the latest CEX.IO crypto highlights. For more information, head over to the Exchange to check current prices, or stop by CEX.IO University to continue expanding your crypto knowledge.

Exchange Plus is currently not available in the U.S. Check the list of supported jurisdictions here.

Disclaimer: For information purposes only. Not investment or financial advice. Seek professional advice. Digital assets involve risk. Do your own research.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments