I see quite a lot of folks scratching their head asking questions like "why the tech of my blockchain is great but its token price is terrible". So I thought maybe it's helpful to write this article to share my PoV and, more importantly, to (hopefully) help folks navigate through the blockchain space.

Blockchain token price appreciation is a complex phenomenon influenced by a multitude of factors. Here I will focus on three key drivers: network performance, liquidity in terms of stablecoin Total Value Locked (TVL), and the role of memecoins. You need all these 3 components to successfully drive network activity hence token appreciation.

Network Performance

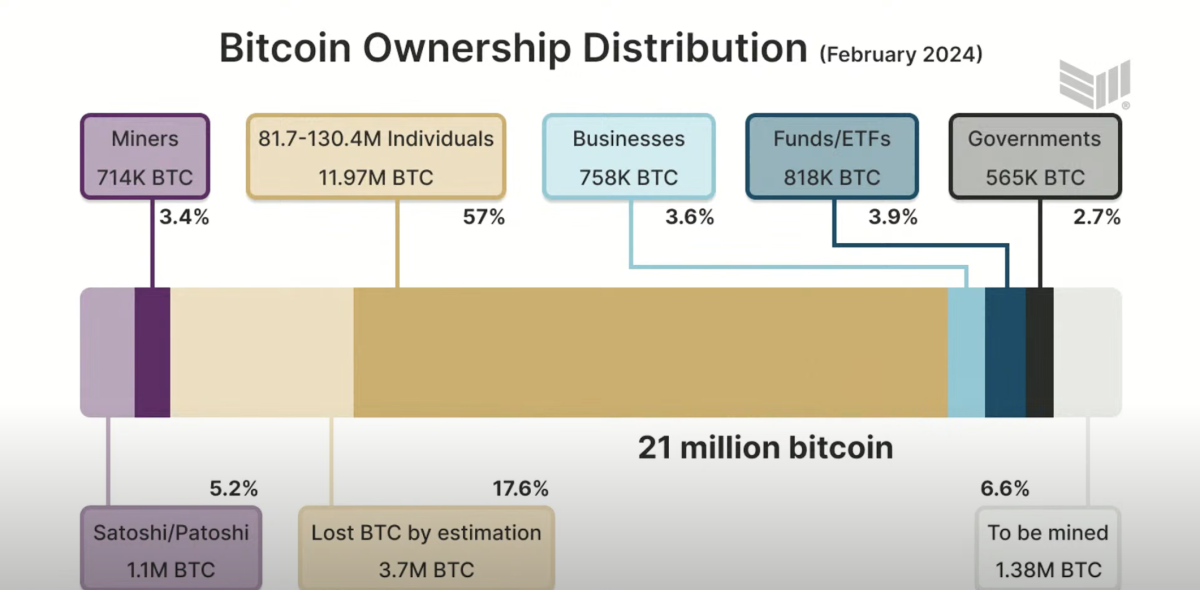

The performance of a blockchain network is a critical factor in the price appreciation of its associated token. A well-performing network can handle significant trading and transaction activities, ensuring smooth and efficient operations. This includes fast transaction times, high scalability, and robust security measures. When a network performs well, it attracts more users and increases the demand for its native token, leading to price appreciation.

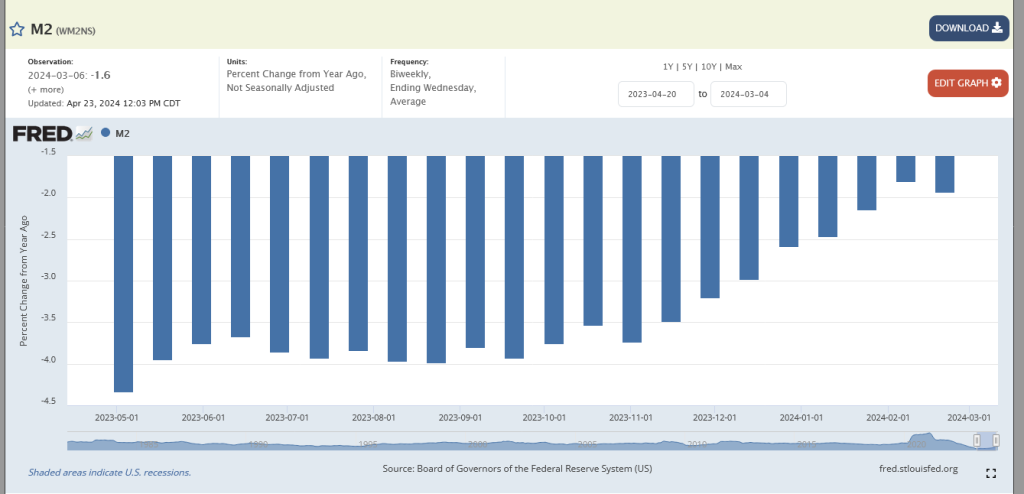

Stablecoin TVL: Liquidity is King

In any financial market, liquidity is king, and the blockchain market is no exception. The total value locked (TVL) in stablecoins (USDC, USDT, etc.) is a measure of the liquidity in the network. The higher the Stablecoin TVL, the more liquid the market, making it easier for traders to buy and sell without impacting the token’s price. Pumping liquidity into a blockchain network can spark price appreciation as it reduces slippage, encourages trading activity, and increases the network’s overall stability. Often, Venture Capitals (VCs) are the main driving forces behind Stablecoin TVL in any network. Love them or hate them, without VCs your blockchain network won't have sufficient Stablecoin TVL to grow.

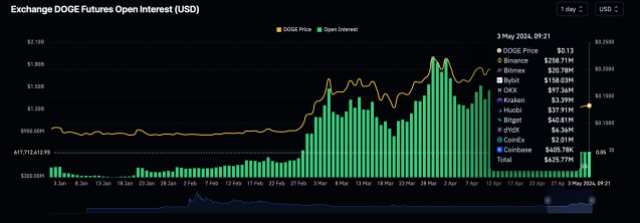

Memecoins: Beyond the Fun and Art

Contrary to popular belief, memecoins are not about “fun” or “art” (these are just "BS" things). These memecoins are actually used to mainly attract novice and/or greedy retail investors into the market. Memecoins serve as a trading vehicle, often used by market makers, venture capitalists, and other influential players to start a “memecoin season”. This coordinated act can lead to a sudden surge in demand for the memecoin, resulting in rapid price appreciation. However, it’s important to note that this often involves a high level of risk and speculation.

So the price appreciation of a blockchain token is influenced by a combination of factors including network performance, liquidity (stablecoin TVL), and the strategic use of memecoins. Understanding these factors can provide valuable insights into the dynamics of the blockchain market.

[link] [comments]

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments